GLOBAL BEST-IN-CLASS GEOCODING

OUR MISSION

Currently, the re/insurance industry relies upon exposure data that is inadequate. Underwriting decisions are based on aggregated data as individual risks cannot be accurately identified. Geocoded information is unreliable, and vital attribute data, such as first-floor elevation, doesn't exist; precise underwriting and portfolio management is simply not possible.

At Insurdata, we solve this fundamental problem using our global world-class geocoding solution leveraging our unique multi-sourced methodology.

We create and manage the highest geocoding resolution data globally

Precise

The highest resolution exposure data to optimize pricing, underwriting, and risk management

Relevant

Delivering relevant geocoding data where it's needed most at any point in the re/insurance chain

Real-time

Generating real-time data from point-of-underwriting to risk transfer

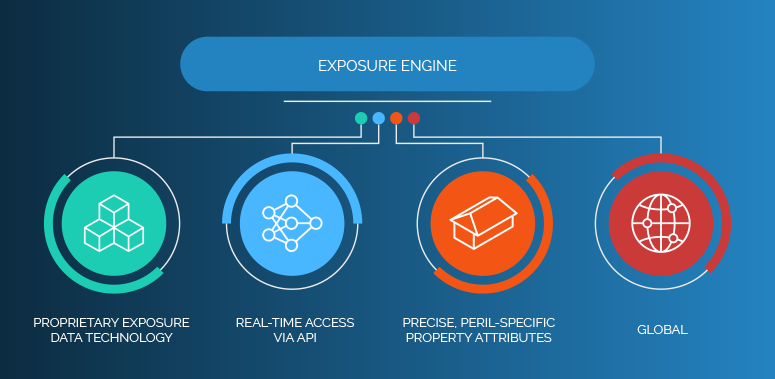

Advanced Exposure Data Platform

Our technology platform delivers the most accurate geocoding data to power better decisions across the insurance value chain.

"For the re/insurance industry to fully exploit the huge potential generated by the advent of high-resolution models, it must have access to data of an equally high resolution, or such advancements are moving us nowhere"

DAG LOHMANN

CEO, KATRISK